A personal loan can be a valuable tool for financing your business—both planned and unplanned. However, if you have no credit history or poor credit, getting approved for a personal loan can be challenging.

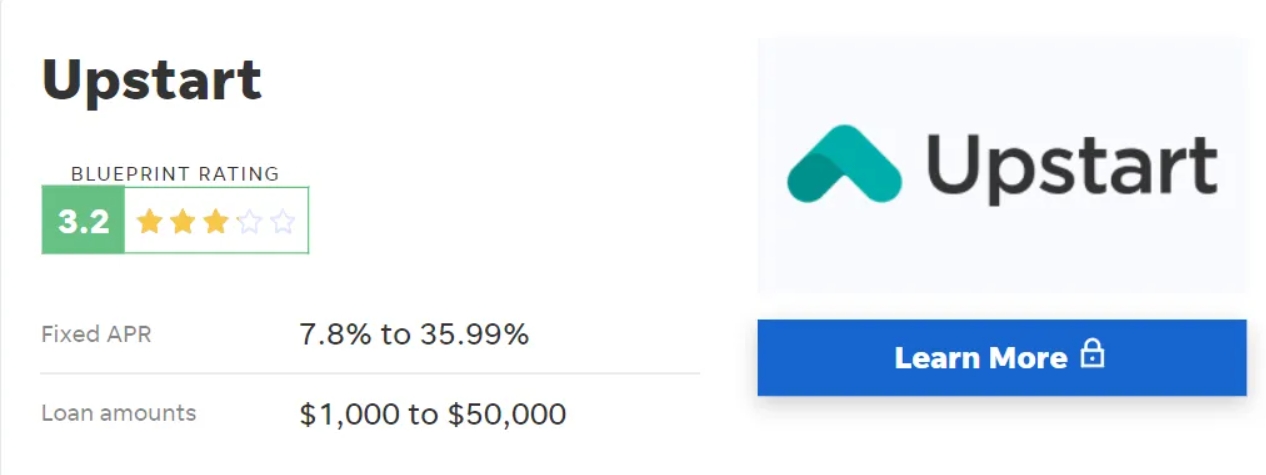

In this case, Upstart Personal Loans may be your first choice. Its loans cater to borrowers who need quick financing but whose credit may not meet the typical underwriting requirements of other lenders.

If you are considering applying for a personal loan from Upstart, click on the image below to access the application.

How to Qualify for an Upstart Personal Loan

Upstart is known for its flexible eligibility requirements, especially when it comes to credit criteria. It requires a minimum credit score of 300 for applicants with enough borrowing history to generate a credit report. However, it also accepts personal loan applications from individuals without a credit score.

In addition to credit-related factors, first-time borrowers applying for an Upstart loan must meet the following parameters to apply:

Be at least 18 years old.

Reside in the United States and have a valid residential address.

Have a regular income or have accepted a job offer that will start within six months.

Have a U.S. personal bank account and routing number.

Have a valid email address.

Have verifiable personal information.

Please note that if your credit score drops by more than 25 points after being approved for an Upstart loan but before it is disbursed, you may be disqualified from receiving funds.

Your loan approval may also be revoked before disbursement if your debt obligations exceed the limits allowed by Upstart, if you are delinquent on any accounts, or if certain new inquiries and accounts are found on your credit report.